LumberFlow In-depth Industry Observation | Gain insight into the trends of giants and seize procurement opportunities

Introduction: In the chess game of global forest products trade, every move of the North American giants may affect your procurement costs and supply chain stability. Do you want to accurately grasp the pulse of the North American timber market, obtain first-hand price intelligence, in-depth industry analysis and reliable sources?Register Now LumberFlow.com, start your smart purchasing journey.

Introduction: A century-old epic of a giant in the forest

North America has one of the most extensive and high-quality forest resources in the world. On this land, a number of world-class forest product companies were born. They have gradually developed from the initial logging camps into multinational giants with businesses all over the world. Their growth history is not only a magnificent business epic, but also a struggle history of constant game with natural resources, market changes, and technological innovation. As the opening of a series of articles, this article will focus on three industry leaders with a long history and far-reaching influence: Weyerhaeuser, West Fraser, and Canfor.

Weyerhaeuser: A century-old evergreen in forestry and the challenges of the times

The rise of lumberjacks: From loggers to forest empire

Weyerhaeuser CompanyThe history of Weyerhaeuser can be traced back to 1900, when it was founded by Frederick Weyerhaeuser. At first, the company only had 900,000 acres of forestland, three employees and a small office in Tacoma, Washington. This largest private land transaction in American history at the time laid the foundation for Weyerhaeuser's future development. After a century of development, Weyerhaeuser has grown into one of the largest sustainable forest products companies in the world. The company showed its attention to the long-term development of the forestry industry in its early days, such as actively participating in forest fire prevention. This responsible attitude towards resources is an important reason for its long-term success.

Weyerhaeuser purchased its first factory in 1902

Core business: A diversified forest products giant

Weyerhaeuser's business segments are diverse and in-depth.Forestry businessIt is the core, not only carrying out sustainable forestry management and seedling sales, but also opening forest land for leisure and recreation, and engaging in land sales, natural gas and mineral resource development.Wood products businessWith a history of over 100 years, Huihao's product line covers engineered wood (such as TJI® joists), oriented structural board (OSB) and structural board, as well as various types of dimensional materials, and has a complete distribution network.Climate SolutionsThe company focuses on renewable energy development, forest carbon sinks, carbon capture and storage (CCS) and ecological protection. This diversified business structure enhances the company's ability to withstand market fluctuations.

Weyerhaeuser's various sub-brands

Brilliant Mark: Innovation and Responsibility of Industry Leaders

Weyerhaeuser is not only one of the largest timber producers in the United States, but also once controlled up to 20 million acres of forestland resources, demonstrating its huge resource control. In 1941, Weyerhaeuser established the first artificial forest farm in the United States, pioneering the American artificial forest farm movement. This initiative had a great impact on the entire industry.The concept of sustainable development has had a profound impactIn addition, Weyerhaeuser has also demonstrated its responsibility as an industry leader in major global events. For example, after the Great Kanto Earthquake in 1923, Weyerhaeuser actively assisted Japan in post-disaster reconstruction, thus establishing a long-term cooperative relationship. During global conflicts, Weyerhaeuser was also a major supplier of defense wood to the United States. These historical fragments have jointly forged Weyerhaeuser's outstanding reputation and leadership in the industry.

Changing circumstances: Optimization and market fluctuations

The forest products industry is constantly changing, and Weyerhaeuser is constantly adapting to the market. In 2024, the company reduced its lumber production capacity by 20 million board feet by closing its New Bern, North Carolina, mill and completing the modernization of its Holden, Louisiana mill. A major recent strategic move was the $375 million acquisition of 117,000 acres of forestland in North Carolina and Virginia (formerly Roanoke forestland assets under Roseburg Forest Products). The transaction, which was mainly financed by divesting non-core assets, further strengthened Weyerhaeuser's presence in the important southeastern market of the United States, demonstrating its optimism about the region's fiber resources and market prospects. However, challenges also follow. In the past three months ending May 2025, Weyerhaeuser's stock price fell sharply by 15.7%, underperforming the overall industry level, mainly due to the decline in export sales, especially the sharp drop in lumber exports to China. This shows that even industry giants like Weyerhaeuser, while actively carrying out internal optimization and strategic expansion, find it difficult to completely avoid the impact of the external macro-environment, especially sudden changes in international trade policies.

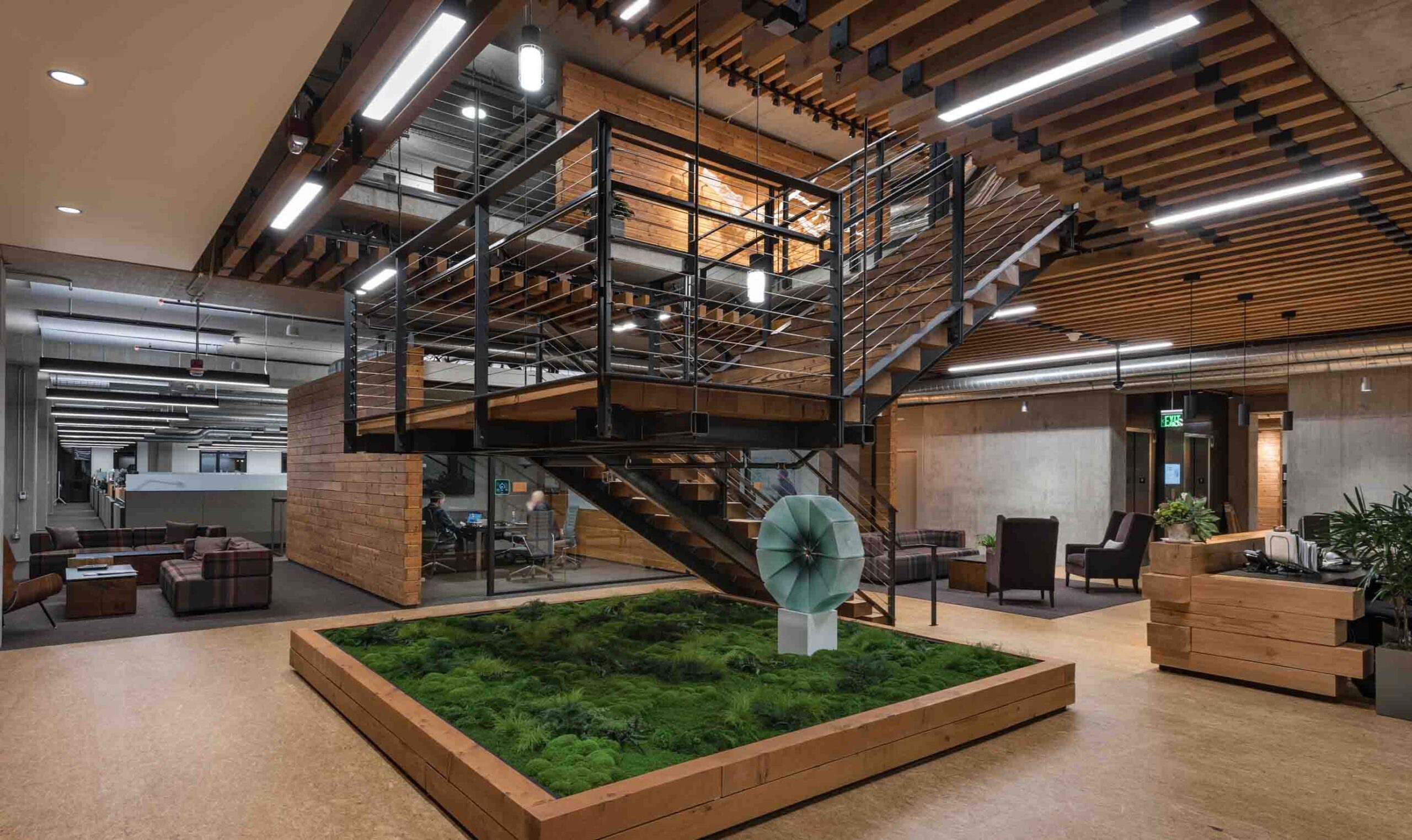

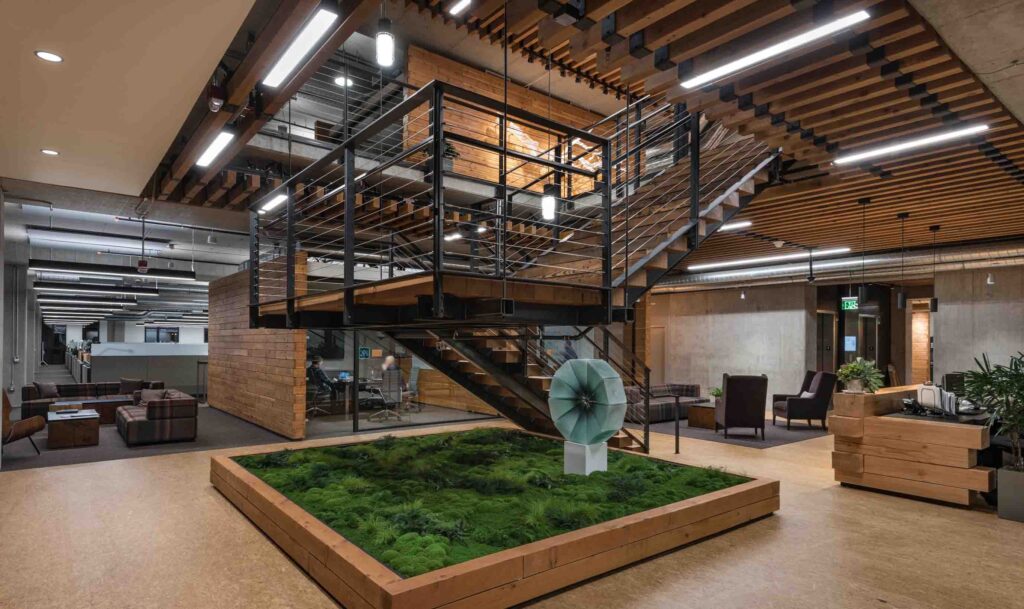

Interior view of Weyerhaeuser's headquarters in Seattle

Love affair with the Chinese market: a roller coaster ride from passionate love to sudden brake

Weyerhaeuser’s relationship with the Chinese market has been full of twists and turns, full of love and hate. Around 2011, in the face of the rapid growth in the Chinese market’s demand for timber, Weyerhaeuser actively expanded its log exports to China. It was a period of mutual benefit and win-win, and the Chinese market provided Weyerhaeuser with important growth opportunities. However, the good times did not last long, and the relationship has recently come to a screeching halt. In the first quarter of 2025, Weyerhaeuser’s demand for logs in China slowed down. More shockingly, in March 2025, Weyerhaeuser was forced to suspend all timber shipments to China due to China’s announcement of an immediate ban on log imports from the United States. This sudden policy change led to a sharp drop in its sales to China and forced it to scale back its export plans to China. Although Weyerhaeuser still regards Asia (including China) as part of its future target markets in its investor report, its log export business to China is currently facing unprecedented difficulties. Weyerhaeuser’s experience in China deeply reveals the geopolitical risks faced by the export of raw materials and commodities. The initial market entry was driven by strong demand (the “love”), while the subsequent ban highlights how political decisions can quickly change trade flows (the “hate”), forcing companies to make major strategic adjustments. This poses a serious challenge to Weyerhaeuser itself and the Chinese importers that rely on its supply.

West Fraser: Global expansion and challenges for Canada's leading forestry company

The road to success: From a small planing plant to the top of North America

West Fraser TimberThe rise of West Fraser is a classic entrepreneurial legend. In 1955, the three Ketcham brothers from Seattle, Sam, Bill and Pete, jointly purchased a small planing mill in Quesnel, British Columbia (BC), and the story of West Fraser began. From an initial team of only 12 employees to the largest lumber producer in North America today, its success is not accidental. The company established core values of focusing on cost control, building modern factories, leading environmental performance, encouraging employee participation and pursuing excellence at the beginning of its establishment, which laid a solid foundation for the company's subsequent steady development. In the company's development history, key leaders such as Henry H. Ketcham, son of "Pete" Ketcham Sr., who not only led the company to a successful initial public offering (IPO) in 1986, but also served as CEO until 2012, playing a vital role in the company's expansion and modernization. By 2018, West Fraser had 8,600 employees worldwide, and its scale was considerable before the subsequent major mergers and acquisitions. This operational efficiency and strategic foresight deeply rooted in the corporate culture is the fundamental reason why it has been able to survive more than sixty years of ups and downs and continue to grow.

West Fraser's first factory in 1955

Core Business: Diversified Forest Products Empire

West Fraser holds a leading position in the market with its diverse product portfolio.woodIt is its cornerstone business, producing large quantities of spruce-pine-fir (SPF) and southern yellow pine (SYP), and also provides species such as Douglas fir and hemlock. The geographical distribution of its timber production is also very strategic. According to data from 2024, 48% of timber was produced in the southern United States, 30% was produced in Alberta, and 22% was produced in British Columbia. This layout effectively disperses regional risks.PlateIn particular, after acquiring Norbord, West Fraser became the world's largest producer of oriented structural board (OSB) and an important plywood manufacturer.Pulp and PaperThe division produces Northern Bleached Softwood Kraft Pulp (NBSK) and newsprint.Engineered Wood Products (EWP)The company has also made great achievements in the field of wood products, including laminated veneer lumber (LVL), parallel wood strand glued timber (Parallam® PSL) and laminated wood strand glued timber (TimberStrand® LSL), and has a European engineered wood products business focused on panels in Europe. This wide product line and strong production capacity in the southern United States and Europe enable it to effectively hedge against risks such as possible fiber shortages in regions such as British Columbia, market downturns in specific product categories, and the Sino-US softwood trade dispute.

Brilliant Imprint: Double Champion Driven by M&A

The deal is expected to be completed in 2021 for approximately 4 billion Canadian dollars (3.1 billion U.S. dollars).Acquisition of Norbord Inc., is a milestone in the development history of West Fraser. This merger not only gave birth to a more diversified global wood products leader, but also made West Fraser theThe world's largest producer of oriented structural board (OSB)Prior to this, West Fraser had already securedThe largest cork producer in North AmericaThe company's stellar history is also reflected in its strong financial performance, such as its stock price achieved significant growth during market booms such as 2017 (stock price rose 73.59%), 2020 (up 47.97%) and 2021 (up 49.9%). Even dating back to 2004, its lumber division had an operating profit of $298 million. This continued leadership is built on the company's long-term adherence to cost control and efficient modern mill operations, and is further consolidated through strategic small-scale mergers and acquisitions such as the acquisition of Spray Lake sawmill in 2023. West Fraser's dual leadership in the North American lumber and global OSB markets was largely achieved through the strategic key acquisition of Noble, which demonstrated its ability to successfully execute large-scale mergers and acquisitions and integrate different businesses.

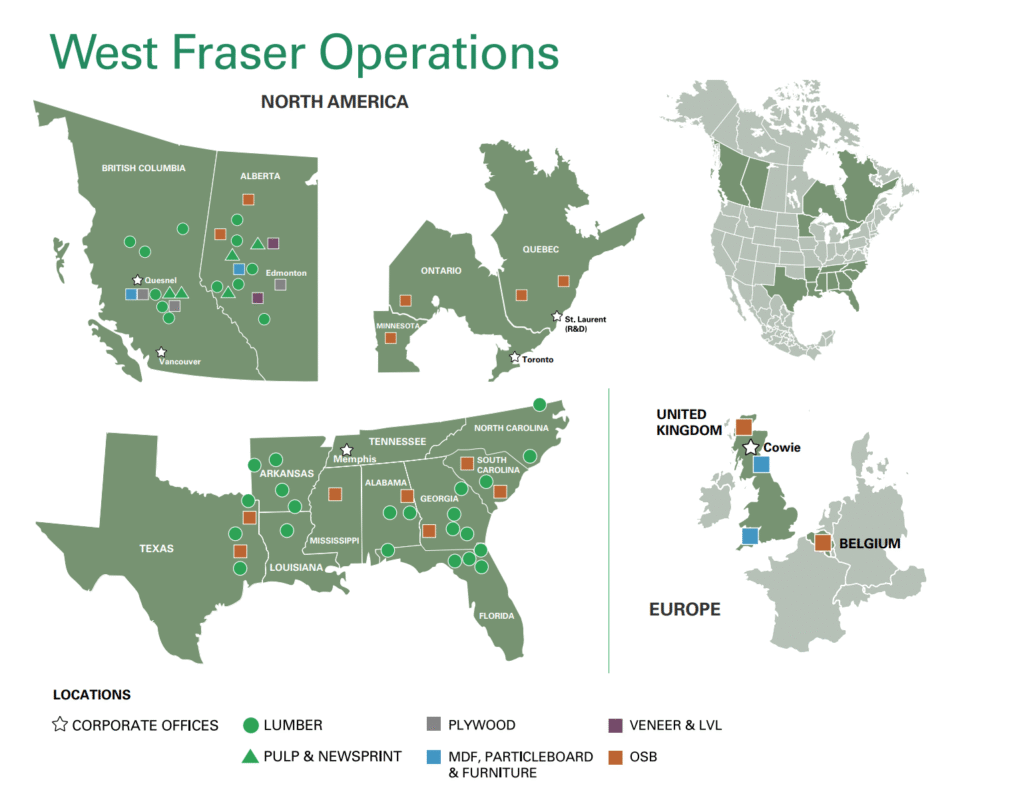

West Fraser has factories throughout North America and Europe

Changing circumstances: Strategic adjustments under multiple pressures

Recently, West Fraser has also faced severe challenges in the market. Although the performance in the first quarter of 2025 improved, with sales of $1.459 billion and a profit of $42 million, the company had previously recorded a net loss of $83 million in the third quarter of 2024. This financial fluctuation reflects the instability of the overall market. In response to the challenges, West Fraser reduced its total production capacity in 2024, closed four mills, and indefinitely cut production at two other mills due to limited access to economically viable fiber and weak commodity prices. The main challenges facing the company include: continued demand uncertainty caused by housing affordability issues, the continued threat and imposition of US lumber tariffs, weak demand for its European panel products, volatile raw material costs, and high environmental compliance costs. Unfortunately, fatal contractor accidents in 2024 and early 2025 have also made safety production a continuing focus of attention. Strategically, the company is committed to product portfolio optimization, cost reduction, factory modernization, maintaining a strong balance sheet, and actively promoting sustainable forestry management, such as the long-term fiber supply agreement reached with the Lake Babine First Nations. Currently, West Fraser is struggling to cope with the intertwined impact of multiple factors such as market cyclical fluctuations, trade protectionism, regional (especially BC) fiber shortages, and operational pressures. Its response is a classic defensive strategy: rationalize production capacity, control costs, and consolidate the balance sheet, while making targeted investments in sustainability and key relationships (such as with First Nations tribes) to ensure future viability.

Interior view of West Fraser's office in Vancouver, Canada

Love for the Chinese market: From a “savior” to a hidden worry

West Fraser’s relationship with the Chinese market began with a strategic adjustment after the collapse of the US housing market in 2007. At that time, the company significantly increased its exports to the Asia-Pacific region, with China, Japan and South Korea becoming its key target markets. By 2013, about 30% of its Canadian production was exported to these markets, compared with only 5-8% in 2007, when Japan was its main Asian market. At that time, West Fraser’s executives were confident in the Chinese market, shifting their sales focus from coastal areas to inland markets, and expected that demand for its timber would continue to grow despite China’s slowing economic growth. This was undoubtedly a mutually beneficial "honeymoon period". However, recent analysis points out that new challenges are emerging, and some data show that West Fraser’s market share in China may face a 15% decline due to import restrictions. This marks a shift in the relationship between the two sides, at least a significant friction, and also reflects the general complexity of international trade with China. The Chinese market was once an important alternative market for West Fraser when demand in the United States plummeted, demonstrating the company's market adaptability. But now the once-booming market is facing new uncertainty due to import restrictions, highlighting the risks of over-reliance on any single export market, especially one that is vulnerable to policy volatility.

Canfor: A multinational forest products giant and a capital storm

The rise of Austrian forestry pioneers in Canada

CanforThe story of Canfor began with turmoil in Europe and opportunity in Canada. In the late 1930s, just before the outbreak of World War II, two Austrian families, John G. Prentice and LLG “Poldi” Bentley, immigrated to Vancouver. They founded Pacific Veneer in 1938 with just 28 employees; by 1939, the mill employed 1,000, driven by wartime demand for aviation and marine materials. Early strategic acquisitions, such as the purchase of the Eburne sawmill in 1940 and the purchase of logging rights in the Nimpkish River Valley in 1944—the latter of which included a small company called Canadian Forest Products Limited—were critical to its growth. The name resonated with the founders, and Canfor was born. By 1948, Canfor was the largest producer of red cedar roofing and siding. Entering the pulp industry in 1951 through the Howe Sound Pulp Company was a key step in its diversification, followed by expansion into Alberta in 1955 and into the Northern Interior of British Columbia in 1963, laying the foundation for what would become a diversified forestry giant. Founded by immigrants fleeing pre-war Europe, Canfor's early and rapid success, driven by wartime needs and strategic acquisitions, embodied a corporate DNA of tenacity and the ability to seize opportunities.

Jiafu's first factory in 1938

Core business: Diversified product lines with global layout

Among North America’s forestry giants, Canfor has one of the most diversified product portfolios.woodThe division offers a broad product line of spruce-pine-fir (SPF), southern yellow pine (SYP) from its southern US operations, Douglas fir and larch, as well as Norway spruce and Scots pine through its majority-owned Swedish subsidiary, Vida Group.Engineered Wood Products (EWP)The company also has a strong presence in the automotive industry, particularly with its Power Products® brand of glulam beams and columns.Pulp and PaperThe company's business includes the independently listed Canfor Pulp, which produces a variety of pulp and paper products using high-quality northern fiber. In addition, Canfor's business also extends toWall panels and decorative panels,Outdoor Products, through the professionalBuilding and packaging solutions, and actively promoteBiological productsThis comprehensive product and market layout is a deliberate long-term strategy adopted by Canfor to hedge against the risks of commodity cycles, regional fiber supply issues and trade disputes.

The Mark of Glory: International Expansion and Sustainable Leadership

Canfor has grown into a leading global manufacturer of low-carbon forest products and was once Canada’s largest lumber producer. An important milestone in its recent history was the acquisition of SwedishVida GroupCanfor acquired 70% shares in 2017, a move that significantly strengthened its position in the European market, expanded its product line into areas such as packaging, and enhanced its portfolio of sustainable wood solutions. The acquisition transformed Canfor from a local sawmill to a global supplier. Earlier, the acquisition of Scotch Gulf Lumber (Fred Stimpson's former company) in 2013 paved the way for its expansion in the strategic southern United States. Canfor also claims to be the world's largest producer of sustainable wood and has invested in green energy and wood pellets. Its stock price reached an all-time high of 35.53 Canadian dollars on May 9, 2021, reflecting the market's peak recognition of its value. Canfor's brilliance is reflected in its strategic international expansion (especially the acquisition of the Weida Group) and its positioning itself as a leader in sustainable forestry. These moves demonstrate its forward-thinking thinking beyond the traditional North American wood cycle to ensure long-term growth and market position.

Changing circumstances: complex situation of market headwinds and shareholder competition

Canfor has experienced dramatic market turmoil recently. The company reported an operating loss of 942.2 million Canadian dollars for the full year 2024, in stark contrast to its past profitable performance. Entering the first quarter of 2025, although the company's performance of a loss of 32 US dollars per share and revenue of 1.42 billion US dollars exceeded analysts' expectations, the company's stock price still fell, reflecting investors' cautious attitude. This highlights the severe challenges facing the market, including the sharp fluctuations in lumber prices, as well as the punitive tariffs of the United States, which are crucial to its Canadian business (facing a combined tariff rate of up to 40.751 TP3T), and the long-term shortage of wood fiber in British Columbia. As a result, Canfor's production in Western Canada fell by 181 TP3T in the first quarter of 2025 after closing a high-cost plant in British Columbia. Currently, Canfor is undergoing a major transformation of its lumber business platform, with about 701 TP3T of production in the first quarter of 2025 coming from outside Canada, of which 401 TP3T was produced in the southern United States. The company has also successfully started up new sawmills in the southern United States (Axis, Alabama; Urbana, Arkansas).Great Pacific Capital Corp. (Jim Pattison)’s controlling position. In 2019, Great Pacific Capital attempted to take Canfor private at C$16 per share, but the attempt was terminated due to failure to obtain sufficient minority shareholder support, which hints at the complex shareholder dynamics within the company and the potential "love-hate" tension with its major investors. Faced with severe market and regulatory pressures on its Canadian business, Canfor is in a period of strategic repositioning. Shifting the focus of production to the southern United States and Europe is a necessary defensive measure. The failure of its controlling shareholder's privatization attempt adds an intriguing layer to the company's governance and future direction. It may mean that there are internal disagreements on the company's valuation or strategic direction, which is an important aspect of its "love-hate" story and may affect its future M&A activities or strategic decisions.

Love for the Chinese market: intensive cultivation and differentiated strategy

Canfor has a deep and lasting relationship with the Chinese market. This relationship began in 2005 when then-CEO Don Kayne visited China for the first time as part of the BC trade delegation. Since then, the Chinese market has rapidly risen in Canfor's export landscape, from accounting for only 1% to one of its top five markets by value (along with the United States and Japan) and ranking second by volume, becoming a core component of its diversification strategy. This deep involvement is particularly evident in itsPulp and Paper BusinessCanfor Pulp has a sales office in Shanghai that also serves the Korean market. The company is actively working with FII China and Canada Wood China to jointly develop and cultivate the market by addressing regulatory standards, strengthening policy advocacy, and technology transfer to Chinese designers and builders. Despite recent global economic uncertainty and specific challenges in China's real estate industry, Canfor maintains a long-term perspective. Although the current Chinese market is expected to remain sluggish (Q1 2025 outlook) and pulp prices have fallen back at the end of the quarter after strengthening at the beginning of the first quarter of 2025, Canfor management believes that these are temporary phenomena rather than long-term declines. Its strategy includes strengthening the position of Canadian lumber in overseas markets, including China, while shifting more BC-produced lumber to the Canadian domestic market due to US tariffs. Canfor's China strategy is characterized by early entry, continued investment and a significant pulp business, which distinguishes it from companies that mainly export lumber. The “love” is reflected in the long-term investment and the key position it has gained from the rise of the Chinese market. The “hate” comes from the current market weakness and the impact of China’s internal economic problems (such as real estate). Its well-developed infrastructure (such as the Shanghai office) and collaborative efforts show that Canfor has greater resilience and adaptability in dealing with these challenges than companies with more transient relationships.

A quick look at North America's forestry giants (Part 1)

In order to give readers a more intuitive understanding of the three giants introduced in this issue, we have compiled the following table:

| Company | Founding Year | Headquarters | Main Product Lines | Recent China Market Focus/Concern |

|---|---|---|---|---|

| Weyerhaeuser | 1900 | United States | Timberland, Wood Products (Dimension Lumber, Engineered Wood such as TJI® Joists, OSB, Panels), Climate Solutions | In March 2025, due to China's ban on imports of U.S. logs, all shipments to China were suspended, and export projects to China have been reduced; historically, the United States has been an important supplier of logs to China. |

| West Fraser | 1955 | Canada | Timber (SPF, SYP, Douglas fir, hemlock), Boards (world's largest OSB producer, plywood), Pulp and Paper (NBSK pulp, newsprint), Engineered Wood Products (LVL, Parallam® PSL), European Engineered Wood Products | Historically, China was viewed as an important export growth point after 2007; recently, there are concerns that China's import restrictions will lead to a shrinking potential market. |

| Canfor | 1938 (predecessor) | Canada | Timber (SPF, SYP, Douglas fir/larch, Norway spruce/pine), Engineered wood products (glulam beams and columns), Pulp & paper, Wall & decking, Outdoor products, Building & packaging solutions (through Vida), Bio-based products | The company has been deeply involved in the Chinese market for a long time and has a pulp sales office in Shanghai. It pays close attention to the Chinese market demand (especially pulp). Although it faces challenges such as a weak real estate market in the short term, it is optimistic in the long run and cooperates with local institutions to promote wooden structure buildings. |

Note: The information in the table is mainly based on public data as of early 2025.

Conclusion and Outlook:

The stories of Weyerhaeuser, West Fraser and Canfor, three century-old giants, reflect the evolution of the North American forest products industry. Their relationship with the Chinese market, from the initial golden age to the complex challenges it faces today, provides us with valuable industry insights.

Want to know what the next move of these giants will be? Want to know the real market price of North American lumber (SPF, SYP, OSB, etc.)? Want to find a stable and reliable North American source of goods?

Register now LumberFlow.com, we provide you with one-stop North American timber procurement solutions, accurate market analysis and a trustworthy supplier network!

Interaction and thinking:

What do you think the Chinese market means for the future strategies of these North American forestry giants? In the current international trade environment, how should Chinese timber importers adjust their strategies to cope with potential risks and opportunities?

WelcomeCommentsIf you find this issue valuable, please leave your comments.LikeandForwardTo more colleagues in the industry.

Please stay tuned to LumberFlow. In the next issue, we will continue to analyze three other heavyweight companies in the North American forest products industry: Interflow, Sierra Pacific and Georgia-Pacific.