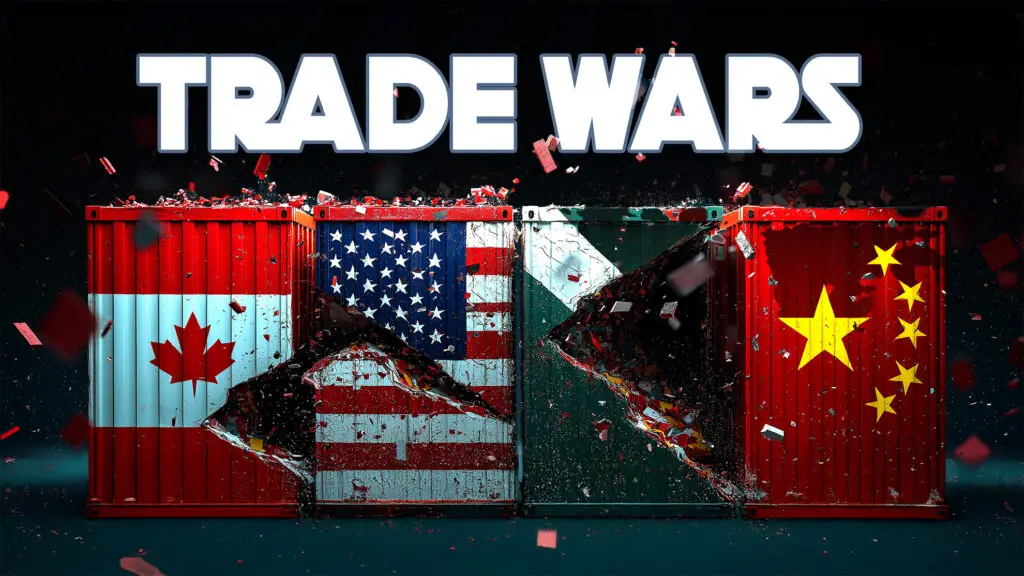

In-depth analysis: US new home sales surged by 10.9%, chain reaction on China's wood supply chain and price index outlook

The annualized sales rate of new single-family homes in the United States in April 2025 reached 743,000 units, a surge of 10.9% from the previous month, indicating strong demand for domestic wood. LumberFlow experts pointed out that this move may lead to a tightening of the supply of US wood exports to China (potential reduction of 5-10% is expected), and the pressure of FOB price increases will be transmitted within 2-3 months. It is recommended that Chinese importers optimize their procurement portfolio, consider increasing supply from Canada, Europe and other places, and adopt strategic inventory management and forward contracts to lock in prices, while paying close attention to market intelligence to respond to changes.