LumberFlow Market Pulse | The 1 Billion Board Foot Supply Cliff: Is Your Inventory Safe? - Week 07, 2026

Lumber market analysis Feb 9-15, 2026: 1 BBF capacity loss, 45% Canadian duties, and 50% Brazilian panel tariffs. Learn to navigate the 2026 supply cliff.

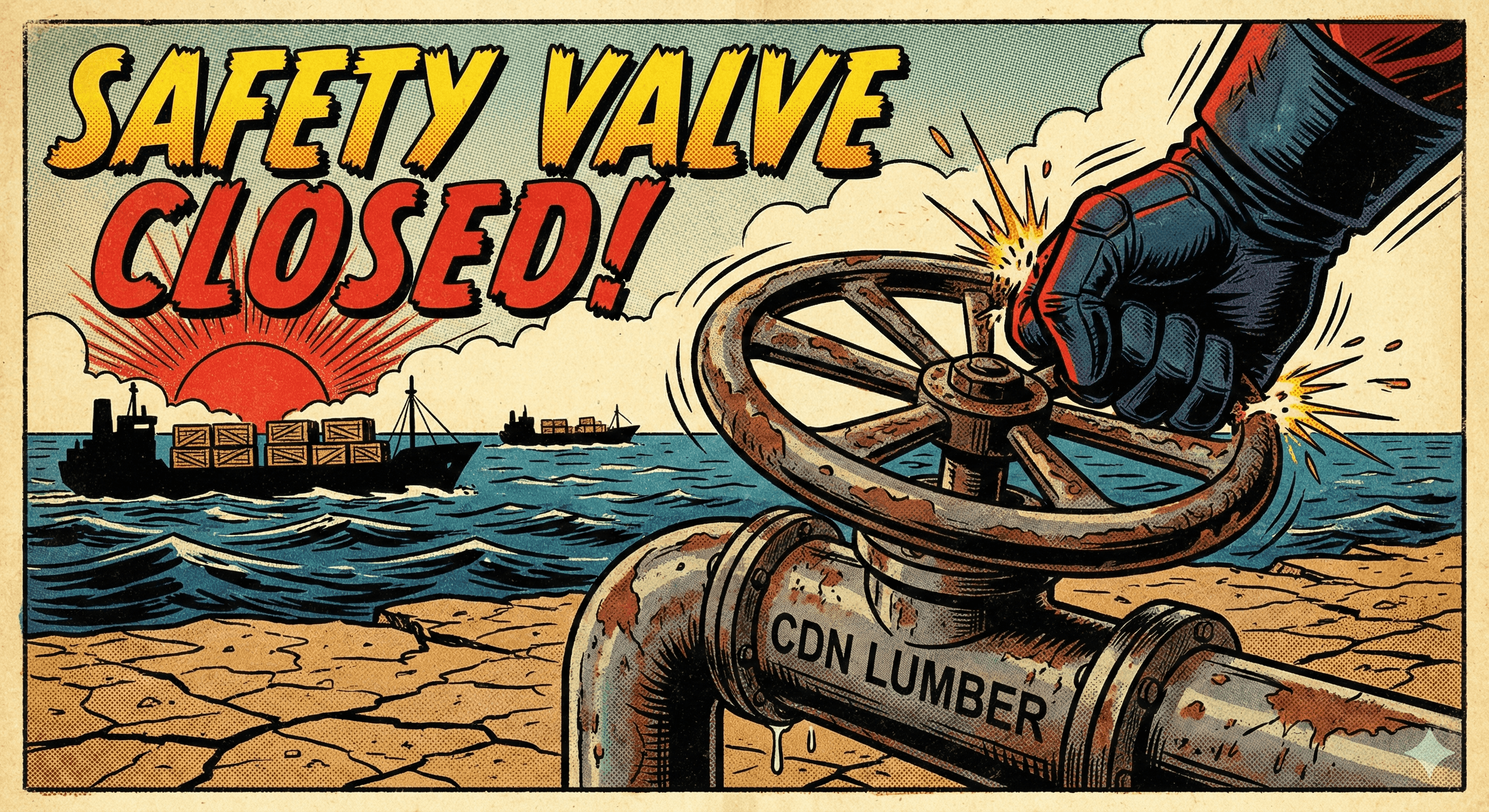

The North American lumber market is hitting a structural wall. With 1 billion board feet of capacity exiting and a 36% surge in Canadian exports to China, the 'safety valve' for US buyers is closing. This week, we analyze why the supply floor is shifting despite macro headwinds—and how procurement managers can secure inventory before the spring surge.

The North American lumber market is hitting a structural wall. With 1 billion board feet of capacity exiting and a 36% surge in Canadian exports to China, the 'safety valve' for US buyers is closing. This week, we analyze why the supply floor is shifting despite macro headwinds—and how procurement managers can secure inventory before the spring surge.

Macro Snapshot

- Interest Rate Pivot: Fed and BoC held steady in January; cooling inflation signals a shift toward 2026 easing, providing a long-term floor for housing demand.

- Labor Market Friction: US job cuts surged 205% in January (highest since 2009). This cooling provides a potential counter-weight to supply-side price pressure.

- Housing Resilience: Despite a weather-driven 14% drop in mortgage apps, the US homeownership rate hit 65.7% in Q4, confirming robust underlying demand.

- Trade Policy Volatility: Combined duties on Brazilian panels have reached 50%, forcing a massive realignment toward domestic US plywood and MDF producers.

Industry Highlights

- Capacity Rationalization: >1 billion board feet of softwood capacity will be permanently removed in 2026 due to financial stress in BC and the US South.

- China Export Pivot: Canadian producers increased Q4 exports to China by 36%, diverting Western SPF to avoid the current 45% US duty regime.

- Southern Pine Disruptions: Arctic storms idled export mills and delayed shipments, tightening immediate availability for saps and prime clears.

- Low-Grade Scarcity: Prices for #3 and economy grades are spiking; #3 Fir & Larch 2x6 gained 16.7% in just four weeks as mills prioritize high-margin products.

- Mill Realignment: Roseburg Forest Products is cutting 146 positions at its Riddle plant, shifting focus from specialty plywood to sheathing and underlayment.

The Structural Squeeze: Why the 'Safety Valve' is Closing

For decades, the North American lumber market operated under a predictable, if sometimes volatile, equilibrium. When domestic production in the United States faltered or demand spiked beyond local capacity, Canadian fiber acted as the indispensable "safety valve," surging across the border to stabilize prices and fill inventory gaps. That era, defined by easy access to Northern bleached softwood kraft and high-quality spruce-pine-fir (SPF), is rapidly approaching its conclusion. The current market is witnessing a fundamental "structural squeeze" that is not merely a cyclical dip, but a permanent reshaping of the supply landscape.

The first pillar of this squeeze is the evaporation of physical capacity. We are currently tracking a projected exit of over 1 billion board feet of operable capacity this year alone. It is critical to distinguish this from the temporary curtailments or "market-related downtime" seen in previous years. This is a permanent rationalization. In British Columbia, aging timber profiles, escalating stumpage fees, and increasingly stringent environmental regulations have rendered many legacy mills economically unviable. Similarly, in the US South, we are seeing a consolidation of "muscle" rather than "fat." As these facilities shutter, the industry loses its ability to respond to sudden demand surges. This reduction in the total manufacturing footprint effectively raises the price floor, creating a baseline that remains elevated regardless of short-term macroeconomic fluctuations or interest rate pivots.

The second pillar involves the redirection of the Canadian "safety valve" toward Asian markets. A 36% surge in Canadian exports to China during the fourth quarter of 2025 serves as a flashing red light for US-based procurement managers. This shift is not accidental; it is a calculated strategic pivot. Faced with punishing 45% cross-border duties, Canadian producers are effectively "voting with their order files." The logic is simple: if the cost of doing business with the United States involves navigating a labyrinth of trade litigation and high tariffs, the burgeoning demand in the Pacific Rim becomes increasingly attractive. By stripping Western SPF volume from the North American market to satisfy offshore contracts, producers are tightening the domestic supply chain just as the critical spring building season approaches. This offshore arbitrage means that the wood traditionally reserved for Chicago, Denver, or Atlanta is now being loaded onto vessels in Vancouver, destined for ports in Shanghai and Ningbo.

Regional Nuances and the Low-Grade Paradox

As the broader market tightens, we are observing a sharp and unprecedented divergence in species behavior. This fragmentation makes a "one size fits all" approach to lumber procurement impossible. To understand the current price action, one must look at the specific technical and fundamental drivers behind the major species groups.

Green Douglas Fir (GDF) currently stands as the primary outlier in the market. Our data indicates a 92% confidence upward bias for GDF, driven by a nearly perfect alignment of tight supply and consistent demand. Unlike other species that have seen fluctuating interest, Douglas Fir remains the gold standard for heavy framing and high-stress applications. The supply side for GDF is particularly constrained due to limited log availability in the Pacific Northwest, where harvest restrictions and log exports have kept mill inventories lean. Buyers who rely on GDF are finding themselves in a "pay to play" environment where securing prompt shipments requires a premium that the market seems more than willing to absorb.

Conversely, Southern Pine (SYP) is exhibiting signs of technical exhaustion. After a period of aggressive price appreciation, SYP has reached a Relative Strength Index (RSI) of 100. In the world of technical analysis, an RSI of 100 is the absolute ceiling, signaling that the species is deeply overbought. While recent regional storms created a significant logistical backlog—temporarily propping up prices through scarcity—the underlying mathematics suggest a period of stabilization is imminent. The vertical climb cannot be sustained indefinitely; a "mean reversion" or at least a plateau is the most likely outcome as transit times improve and the initial shock of weather-related disruptions fades.

Perhaps the most fascinating development in the current cycle is The Low-Grade Paradox. Historically, #3 grade and economy-grade lumber were the "cheap" alternatives, often ignored by premium builders and used primarily for pallets, crating, or temporary bracing. However, as mills increasingly focus their limited production capacity on high-margin premium items to offset rising operational costs, a massive vacuum has formed in the lower-grade markets. We recently witnessed #3 Fir & Larch outpace higher grades with a staggering 16.7% jump in a single month. This is a significant signal: it indicates that the market floor is being aggressively bid up by industrial buyers. These buyers, who once relied on a steady stream of "utility" wood, can no longer find inexpensive fiber. When the bottom of the market moves faster than the top, it compresses the price spreads and forces an upward revaluation of the entire lumber complex.

Trade Policy and the Brazilian Panel Shock

While dimensional lumber is navigating its own internal pressures, the panel market is facing a violent adjustment that will have significant "splash-over" effects on the entire wood products industry. The imposition of a 50% total tariff on Brazilian plywood imports—comprised of a 40% anti-dumping duty combined with a 10% baseline tariff—is nothing short of a supply chain earthquake.

To understand the scale of this disruption, one must consider that Brazil supplied nearly half of all US plywood imports in 2025. This fiber was the backbone of the North American sheathing market, providing a low-cost alternative for residential construction and industrial packaging. With the stroke of a pen, that supply has become prohibitively expensive for many importers. We expect a massive and immediate pivot toward domestic US Southern Pine (SYP) producers to fill this void.

This pivot creates a secondary "squeeze" on dimensional lumber. As plywood mills in the US South ramp up production to capture the market share vacated by Brazilian imports, they will compete directly for the same Southern Pine logs used by dimensional lumber sawmills. This increased competition for the "raw log" will inevitably drive up stumpage costs. Therefore, even if demand for 2x4s were to remain flat, the cost of the raw material will rise because of the crisis in the panel market. The interconnectedness of the SYP log market means that a tariff on Brazilian plywood is, in effect, a hidden tax on Southern Pine lumber.

Weekly Forecast and Scenario Planning

Navigating the next several weeks requires a disciplined approach to inventory management and a keen eye on specific "trigger events." Below are the detailed outlooks for the primary species groups, along with the scenarios that could shift their current trajectories.

Eastern SPF (ESPF)

- Bias: STABLE (74% confidence)

- Scenario Analysis: The immediate future of ESPF hinges on the upcoming AR7 administrative review. If the review suggests that duties might drop to the 15-20% range by the summer, we expect a period of "buyer paralysis." Large-scale wholesalers and retailers may choose to hold off on significant purchases, betting on lower landed costs in the third quarter. However, if the review maintains the status quo or indicates higher duties, the "China pivot" mentioned earlier will accelerate. In that scenario, domestic stocks in the Northeast and Great Lakes regions will drain rapidly, turning a "stable" market into a "tight" one almost overnight.

Western SPF (WSPF)

- Bias: UP (65% confidence)

- Scenario Analysis: WSPF is currently tracking the upward momentum of Green Douglas Fir. The primary variable for WSPF is the pace of offshore exports. If demand from Asian markets maintains its current 36% growth clip through the end of the month, domestic availability will tighten significantly by February 13. Buyers should watch the Vancouver port data closely; any delay in domestic rail shipments combined with high vessel loadings will create a localized shortage in the US Midwest and Southwest.

Southern Pine (SYP)

- Bias: STABLE (79% confidence)

- Scenario Analysis: Despite the technical warning of a 100 RSI, SYP is unlikely to see a significant price correction in the near term. The combination of the weather-related shipping backlog and the sudden shift in the panel market (due to the Brazilian tariffs) provides a very strong support level. While the "vertical climb" may pause, expect localized premiums for prompt shipments to persist. If transit times from the mills to the distribution centers do not show marked improvement by mid-February, we could see a secondary price spike driven by "panic buying" from distributors whose inventories have run dangerously low.

Green Douglas Fir (GDF)

- Bias: UP (84% confidence, +2.1% forecast)

- Scenario Analysis: GDF remains the primary growth engine of the softwood complex. With a historical volatility of 14.2%, this species presents both the highest risk and the highest necessity for early procurement. The window to fill requirements for late February and early March is closing rapidly. Because GDF production is so concentrated, any localized disruption—be it a mill breakdown or a mountain pass closure—will have an outsized impact on price. For those with significant Douglas Fir needs, the strategy should be "secure now," as the probability of finding cheaper wood in the next 30 days is statistically low.

The overarching theme for the current market is one of "constrained options." The safety valves are being diverted, the regional leaders are hitting technical limits, and trade policy is forcing a domestic log war. In this environment, the most successful market participants will be those who recognize that the old rules of "waiting for the dip" may no longer apply in a structurally smaller industry.

How LumberFlow Helps

Navigating this supply cliff requires real-time data. Use LumberFlow’s multi-supplier RFQ workspace to compare quotes instantly. Pressure-test your suppliers against our weekly price forecast and use AI-generated inquiries to secure volume before the spring surge. Book a strategy consultation to map these shifts to your specific region.

Ready to stay ahead of market shifts? Book a consultation to see how LumberFlow streamlines dimensional lumber buying.

Action Plan for Buyers

- Prioritize GDF and Low-Grade Buys: With GDF showing a 92% upward signal and #3 grades scarce, finalize these orders by Feb 11 to beat the predicted 2.1% uptick.

- Hedge the Panel Pivot: If you rely on Brazilian plywood/MDF, qualify domestic SYP suppliers immediately. The 50% tariff will cause a permanent shift in sourcing and log competition.

- Monitor BC Mill Allocations: Watch offshore diversion closely. If volume continues to move to China, WSPF prices will decouple from domestic demand and spike on pure scarcity.

Related Insights

Continue exploring lumber market analysis

Turn Market Insights Into Action

LumberFlow automates quote tracking, RFQ generation, and supplier negotiations so you can focus on strategic procurement decisions like the ones highlighted in this article.

Need help applying this insight?

Talk with a LumberFlow analyst about procurement playbooks tailored to your SPF program.