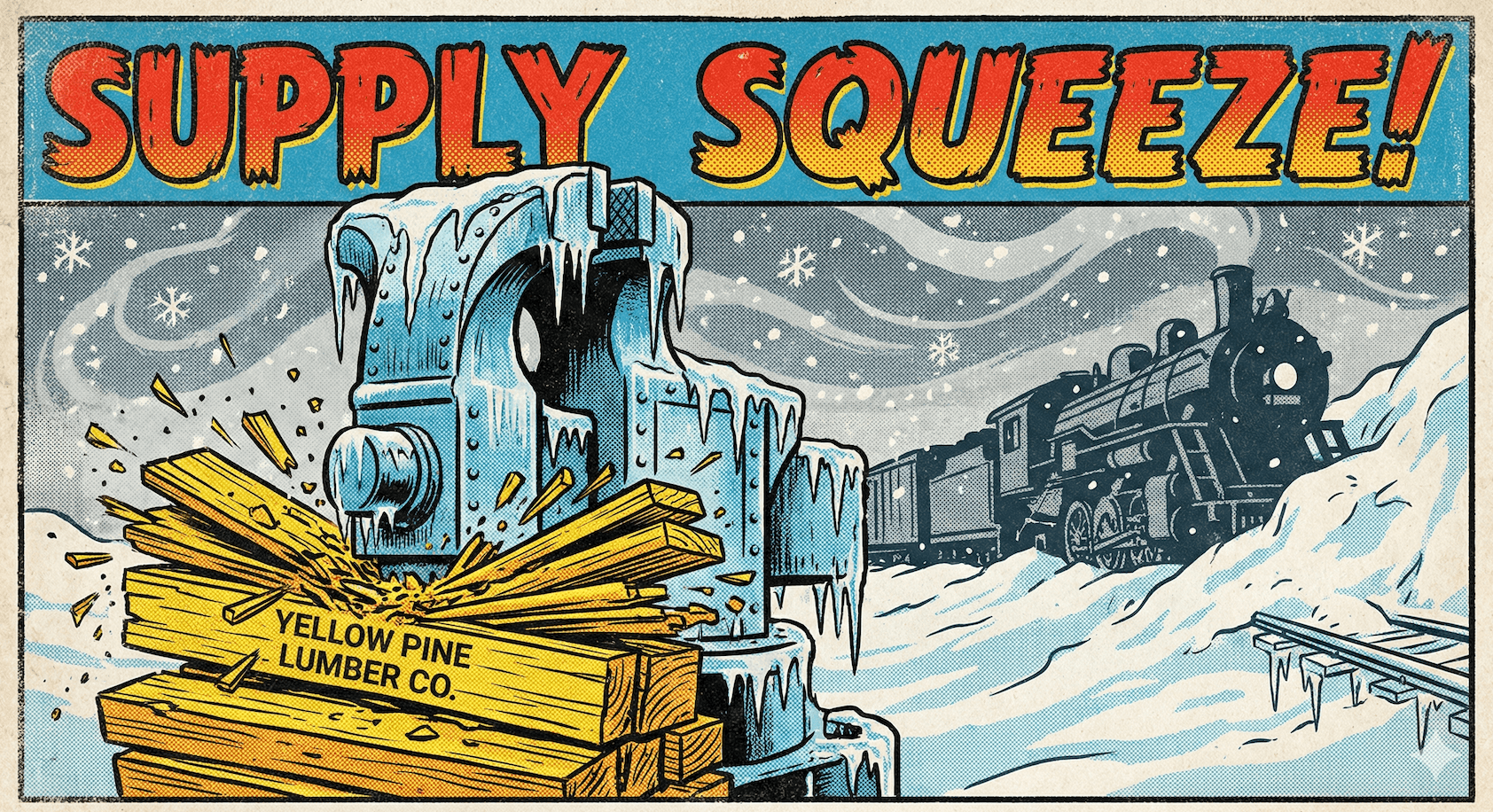

Rising Homeownership and Winter Storms Create Market Tension

US homeownership hits 65.7% as lumber prices enter an accelerating rally. Learn why mortgage dips won't stop the 2.8% price hike forecast for Feb 6.

The US homeownership rate rose to 65.7% in Q4, signaling resilient underlying demand despite recent mortgage application declines. While Winter Storm Fern caused a temporary 14% drop in purchase applications, an accelerating rally in framing lumber prices suggests buyers should act now. Lock in February requirements before the predicted 2.8% price increase by Feb 6.

Impact on Your Procurement Strategy

The current market presents a complex tug-of-war between bullish price momentum and temporary macro headwinds. On one hand, the latest FEA data confirms that the US homeownership rate edged up to 65.7% in late 2025. This move was driven largely by householders under age 35, a demographic that saw a 1.6 percentage point increase. For lumber distributors, this is a critical long-term signal: the 'starter home' segment remains the primary engine for framing lumber consumption, even as affordability remains strained. However, more recent data from the week ending January 30 shows a 8.9% decline in mortgage applications, largely attributed to the disruptive effects of Winter Storm Fern. This weather-related dip in activity has created a brief disconnect between physical demand and pricing direction.

Despite the slowdown in mortgage filings, the framing lumber market is currently in an accelerating rally. We have observed a strong upward trajectory over the last three weeks, with prices moving significantly higher. This momentum is currently the dominant market signal, outweighing the 'stale' macro data from Q4. The high volatility regime, currently sitting at 16.1%, suggests that price discovery is aggressive and that mills are successfully pushing for higher levels as they look toward the spring building season. The 6.21% average for 30-year fixed mortgages, while not low enough to trigger a refinance boom, has stabilized enough to keep purchase activity 4.0% higher than this same week last year on an unadjusted basis.

For procurement managers, the immediate risk is waiting too long for a 'weather correction' that may not materialize in the pricing sheets. While the mortgage index fell 14% last week, this is viewed by the market as a transitory event caused by snow-ins rather than a fundamental shift in buyer appetite. With the LumberFlow ML forecast predicting a 2.8% price increase by February 6, the window to secure early-Q1 inventory at current levels is closing rapidly. Regional supply remains tight, and the uptick in rental vacancies to 7.2% suggests that more consumers may be transitioning toward homeownership, further tightening the existing home supply and necessitating new construction.

We recommend prioritizing coverage for Western SPF and Southern Pine framing lumber immediately. The technical signals, including an RSI of 70, indicate the market is in overbought territory, but in a high-volatility uptrend, prices often stay elevated longer than technicals suggest. Buyers should focus on securing 2-4 week lead times now to avoid the logistics crunch that typically follows major winter storms. If you have open orders for late February, finalize those commitments before the end of the week to hedge against the predicted price escalation.

Key Takeaways

Homeownership among buyers under 35 rose 1.6%, confirming a strong long-term demand floor for entry-level framing lumber despite current affordability challenges.

The 14% drop in purchase applications is likely a temporary weather-driven anomaly; do not mistake this for a fundamental cooling of the current price rally.

Lumber prices are in an accelerating rally with HIGH volatility; current momentum suggests further upside regardless of short-term mortgage fluctuations.

Market Outlook

Pricing Trend: UP

Confidence Level: MEDIUM

Recommended Action: Finalize February framing lumber purchases by Feb 6 to avoid the predicted 2.8% price hike. Do not wait for a 'weather dip' in pricing, as current bullish momentum is overriding short-term mortgage application declines.

How LumberFlow Helps

Utilize the weekly price forecast to identify the optimal entry point before the next 2.8% move. By integrating these daily market insights with your procurement workflow in LumberFlow, you can leverage agentic sentiment analysis to validate mill quotes against real-time market trends.

Ready to stay ahead of market trends? Book a consultation with our team to see how LumberFlow's procurement platform transforms dimensional lumber buying.

Source:FEA End-Use Macro Snapshot

Related Insights

Continue exploring lumber market analysis

Turn Market Insights Into Action

LumberFlow automates quote tracking, RFQ generation, and supplier negotiations so you can focus on strategic procurement decisions like the ones highlighted in this article.

Need help applying this insight?

Talk with a LumberFlow analyst about procurement playbooks tailored to your SPF program.