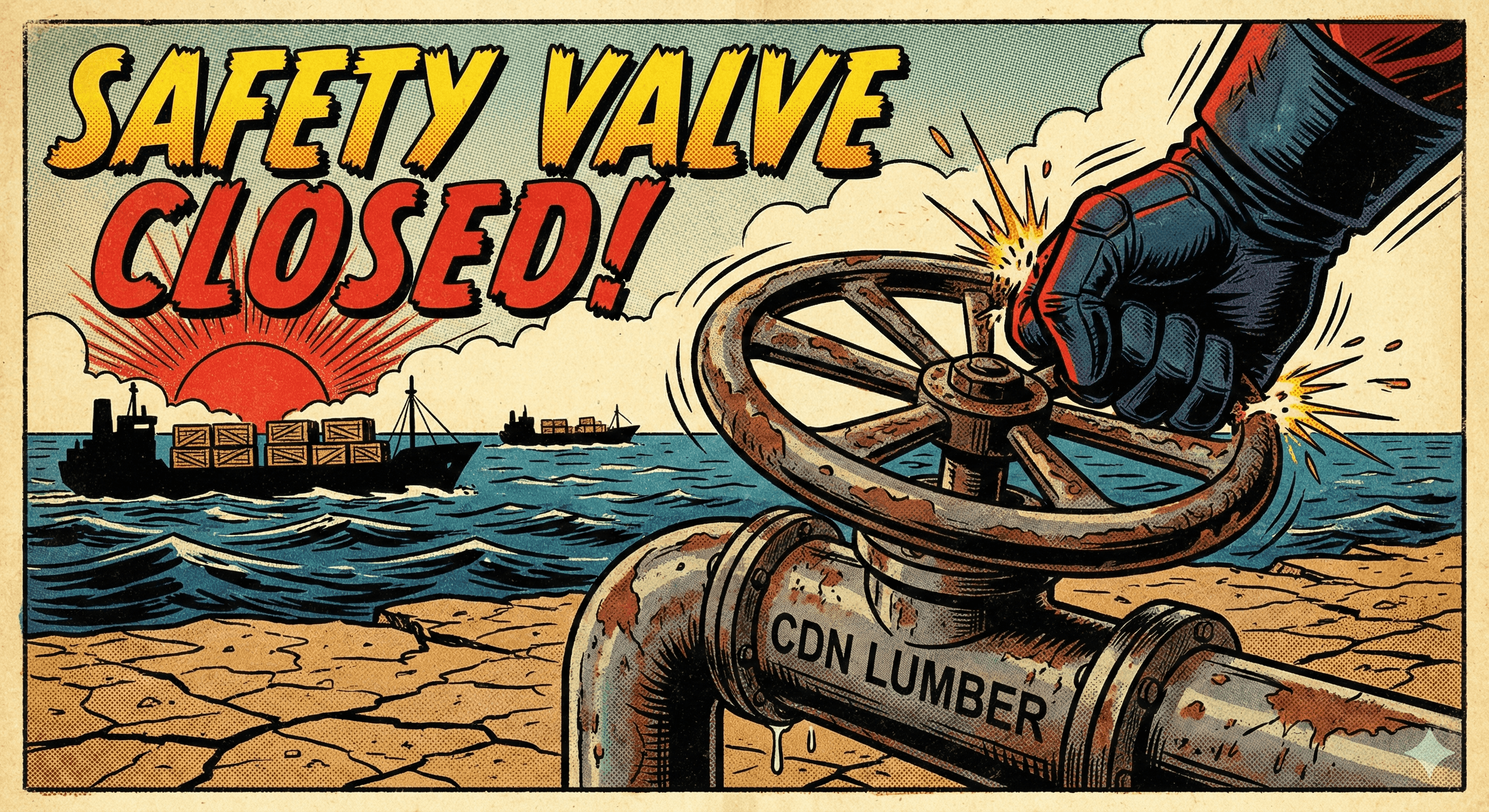

Housing Sales Dip 8.4%: Why Lumber Prices are Topping Out

Lumber prices face a plateau as US existing-home sales drop 8.4% in Jan. Analysts recommend fill-in buying as market momentum cools.

Existing home sales fell 8.4% in January , signaling a disconnect between recent lumber price gains and actual housing turnover. While mortgage rates are hitting three-year lows , rising delinquencies suggest a cautious consumer. We recommend shifting to fill-in buying only as the market searches for a new floor.

Impact on Your Procurement Strategy

The recent 6.2% surge in framing lumber prices is facing a significant reality check following the latest macro data. While the market has enjoyed strong upward momentum over the last three weeks, the National Association of Realtors' report of an 8.4% drop in existing-home sales for January suggests that the underlying demand for residential wood products may not be as robust as recent price action implies. This represents a classic disconnect where price momentum has outpaced the actual pace of construction and home turnover, creating a risk for buyers who continue to chase the rally at these levels.

From a technical perspective, the market is currently showing signs of being overextended. Our internal indicators show a price position that is 11.4% above the 12-week moving average, with a momentum reading (RSI) of 74 . In plain English, this means the market has moved 'too far, too fast' and is due for a period of cooling or consolidation. Because the market is currently in a HIGH volatility regime, these technical signals often precede a plateau or a reversal when demand-side news turns negative, as it did this week with the housing sales data.

While there are some silver linings—specifically mortgage rates averaging 6.09% (a three-year low) and a decrease in weekly jobless claims to 227,000 —these are lagging indicators for lumber demand. The more immediate concern for procurement managers should be the rising mortgage delinquency rates, which hit 4.26% in Q4. The sharp spike in FHA delinquencies to 11.52% is particularly concerning, as it suggests the entry-level buyer—a key driver of new construction and remodeling activity—is under increasing financial strain. Furthermore, the unsold inventory of homes rose to a 3.7-month supply , reducing the urgency for builders to start new projects.

Given that our ML forecast has shifted to STABLE with a confidence score of 0.65 , the risk-reward profile for aggressive inventory building has deteriorated. We expect the market to move sideways in the coming week as distributors digest the housing sales slump and wait for more clarity on spring building permits. Buyers should focus on maintaining high inventory turns rather than locking in large volumes at current levels. The current price level is vulnerable to a correction if the spring buying season does not kick off with more vigor than the January sales data suggests.

Key Takeaways

Existing home sales fell 8.4% in January, suggesting recent 6.2% lumber price gains may lack sustained demand support.

Inventory of homes rose to a 3.7-month supply, the highest in over a year, reducing immediate pressure on new construction.

Market momentum is 'overbought' (RSI 74), indicating a high probability of a price plateau or near-term correction.

Market Outlook

Pricing Trend: STABLE

Confidence Level: MEDIUM

Recommended Action: Halt aggressive inventory building and limit procurement to immediate-need fill-in orders through Feb 20 . Avoid locking in large volumes while prices remain 11.4% above their 12-week average and housing turnover is declining.

How LumberFlow Helps

Use the weekly price forecast to identify the next entry point once the current volatility subsides, and monitor the free daily market insights for shifts in housing starts. Buyers can use LumberFlow to automate RFQs for fill-in needs while maintaining a lean inventory strategy.

Ready to stay ahead of market trends? Book a consultation with our team to see how LumberFlow's procurement platform transforms dimensional lumber buying.

Source:FEA End-Use Macro Snapshot

Related Insights

Continue exploring lumber market analysis

Turn Market Insights Into Action

LumberFlow automates quote tracking, RFQ generation, and supplier negotiations so you can focus on strategic procurement decisions like the ones highlighted in this article.

Need help applying this insight?

Talk with a LumberFlow analyst about procurement playbooks tailored to your SPF program.