Lumber Prices Plateau as Canadian Housing Outlook Dips

Lumber prices rose 6.2% but momentum is slowing. CMHC projects housing start declines through 2028. See why we shifted to a STABLE pricing outlook.

Framing lumber prices rose 6.2% over three weeks, but momentum is decelerating. While the market has been BULLISH, weak CMHC forecasts and rising small business uncertainty suggest a pricing plateau. Procurement managers should transition to immediate-need buying and avoid over-extending inventory at these levels.

Impact on Your Procurement Strategy

The framing lumber market is signaling a late-stage rally. While the composite price surged 6.2% recently—remaining 11.4% above the 12-week moving average—gains are slowing. Technical indicators (RSI at 74) suggest the market is overextended. Procurement strategy must shift: the 'buy now' phase is ending, making way for STABLE pricing.

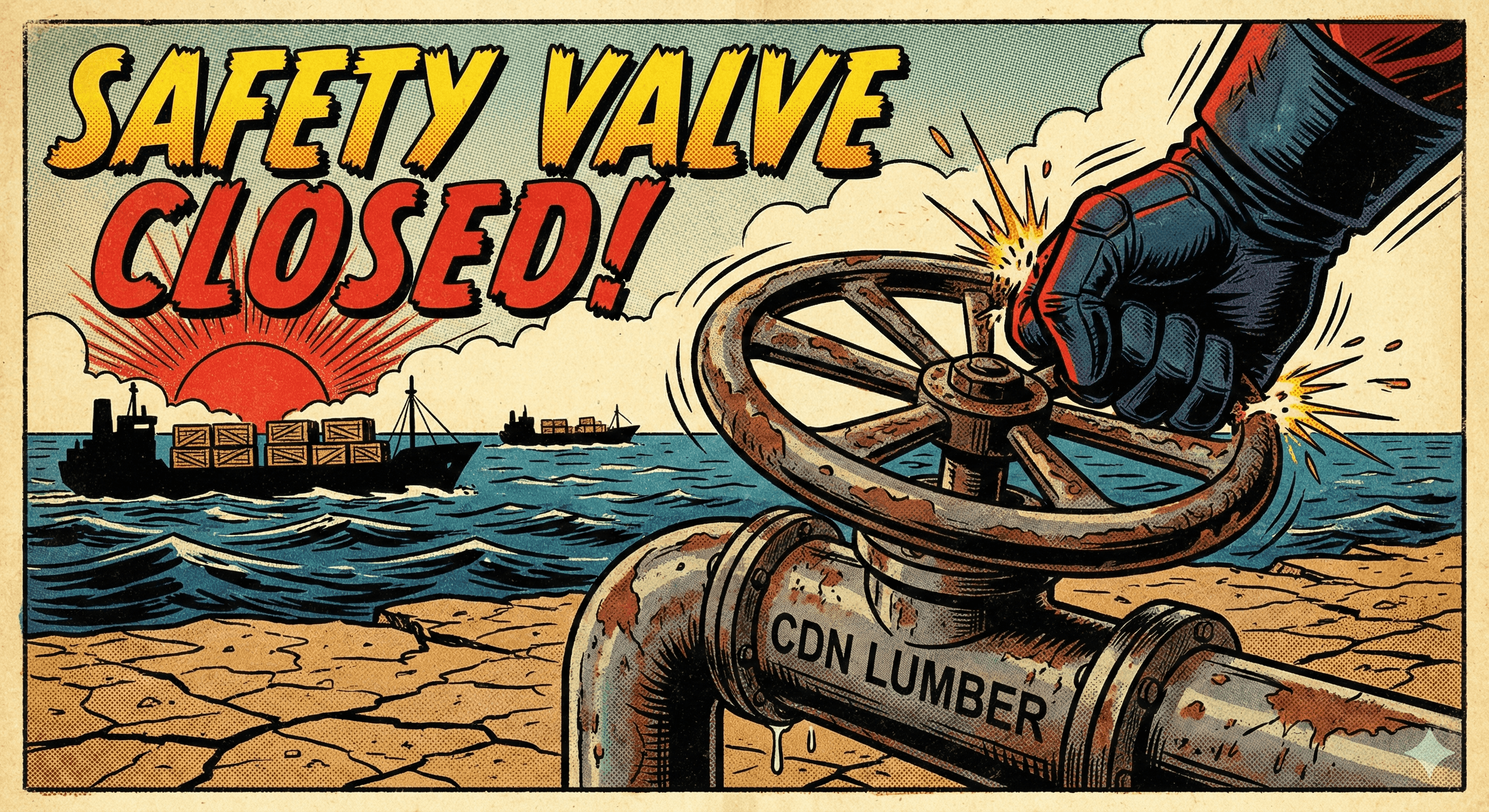

This pivot from our BULLISH stance follows new CMHC data. With Canadian real GDP projected at 0.7% in 2026 and housing starts declining through 2028, the demand floor for SPF is softening. Despite 2025 US tariffs keeping landed costs high, weak construction momentum in Ontario and BC suggests supply may soon outpace demand.

Additionally, the NFIB Uncertainty Index jumped 7 points to 91, reflecting caution among small builders. While sales expectations rose 6 points, reluctance to expand operations favors hand-to-mouth buying. With ML models predicting STABLE pricing ( 65% confidence) over the next seven days, we recommend a tactical pause on speculative loading. Focus on high turnover and monitor regional variations, particularly in the Great Lakes region.

Key Takeaways

Shift to fill-in buying; the 6.2% price surge is losing momentum as technical indicators reach overbought levels.

Prepare for a pricing plateau; ML models show 65% confidence in a stable trend over the next 7-10 days.

Monitor Canadian supply; CMHC projects housing start declines through 2028, likely triggering mill curtailments.

Market Outlook

Pricing Trend: STABLE

Confidence Level: MEDIUM

Recommended Action: Execute immediate-need purchasing only by Feb 13. Halt aggressive inventory building as the 6.2% price rally hits technical resistance, signaling an imminent plateau or correction.

How LumberFlow Helps

Track this rally's deceleration via the weekly price forecast to time Q2 entries. Monitor Canadian trade policy impacts on SPF via daily market insights. Leverage agentic sentiment tools on the LumberFlow platform for real-time risk assessment.

Ready to stay ahead of market trends? Book a consultation with our team to see how LumberFlow's procurement platform transforms dimensional lumber buying.

Source:FEA End-Use Macro Snapshot

Related Insights

Continue exploring lumber market analysis

Turn Market Insights Into Action

LumberFlow automates quote tracking, RFQ generation, and supplier negotiations so you can focus on strategic procurement decisions like the ones highlighted in this article.

Need help applying this insight?

Talk with a LumberFlow analyst about procurement playbooks tailored to your SPF program.